Coronavirus sinks global oil markets with no bottom in sight

03/23/2020 / By Michael Alexander

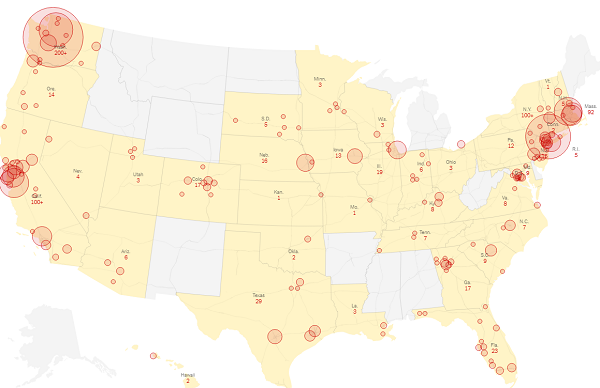

Gas prices are expected to slide down further this month, according to fuel price analysts. This is after oil prices plunged by as much as 26 percent on Wednesday? — an 18-year low.

Patrick De Haan, Head of Petroleum Analysis at Gas Buddy, said the worldwide decline in crude oil prices can be linked to the current COVID-19 coronavirus pandemic.

“The coronavirus has caused countries to be in lockdown, limiting driving, flying and overall movement in order to contain the spread. This means very little need for oil,” De Haan said, noting that the resulting lockdowns triggered a chain reaction and affected other countries as well.

De Haan also expects the national average to soon hit $1.99, with $1.49 on the horizon and some stations even potentially pricing a gallon of regular as low as 99 cents. The last time prices dropped below $1.60 was during the 2008 financial crisis, where it fell from a July high of $4.10.

While consumers? — or those who are still allowed to travel amidst countless lockdowns being implemented throughout the country? — may be feeling ecstatic over looming price reductions in fuel, business analysts say they are starting to feel a chill coming.

“The market is cascading. It’s trying to search for a bottom and it doesn’t seem able to find one,” Gene McGillian, vice president of research at Stamford, Connecticut-based firm Tradition Energy, said in a report by Reuters.

“There are fears of an economic collapse because of what this virus represents, globally,” McGillian said.

Challenges in both supply and demand

In addition to the coronavirus, another more pressing issue is impacting the price of petroleum on the global market: the tug-of-war between petroleum giants Saudi Arabia and Russia.

The global oil market was already at a slump when Saudi Arabia decided this month to increase its supply, as well as slash prices. According to the report, the kingdom’s move was done in retaliation to Russia’s refusal to cut output in anticipation of weaker global demand due to the coronavirus.

According to Business Insider, the kingdom is set to increase its oil production to 12.3 million barrels per day (BPD) from about 9.7 million.

Moscow, meanwhile, is also set to increase its production, with Energy Minister Alexander Novak claiming that the country can ramp output by 500,000 BPD.

As a result, Brent crude traded at $26.01 Wednesday, down by around 9 percent, while U.S. West Texas Intermediate (WTI) stood at $22.73, which is more than 15 percent lower.

According to analysts, if the price war between Saudi and Russia continues, the world oil market will likely see a massive surplus that could easily overwhelm global storage. (Related: Coronavirus sinks Dow into bear market territory, other major indices down 5% – the bear is back with a vengeance)

“In our base case, inventories would rise by an almost unprecedented 4 million BPD in the second quarter,” analysts at Bank of America said, adding that this number could still climb up to as high as 10 million BPD in a severe surplus.

Michael Lynch, president of Strategic Energy & Economic Research, in an interview with MarketWatch, described the current oil market situation as “the worst I’ve ever seen.”

“The problem is that distressed companies might feel the need to dump at any price, which will create pain throughout the industry unlike anything seen before,” Lynch said.

Sources include:

Tagged Under: Collapse, coronavirus, covid-19, crude oil, economic collapse, economics, economy, energy, finance, gasoline, oil markets, pandemic, petrol, petroleum, petroleum products, priority, risk

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 MARKET CRASH NEWS