Russia switches to China-based credit card system after VISA, MasterCard ban as global financial realignment quickens

03/10/2022 / By JD Heyes

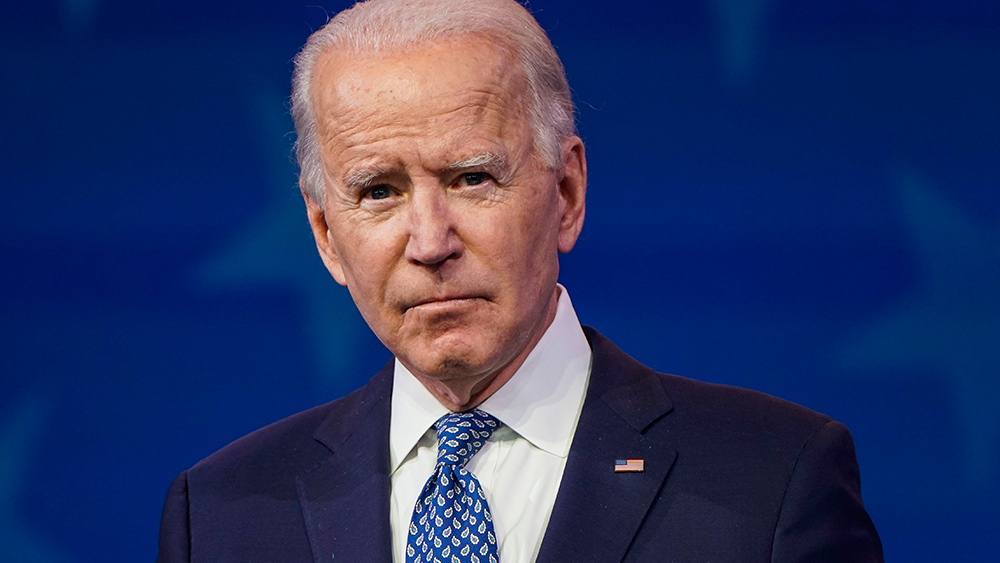

The Russian invasion of Ukraine has jump-started a massive global realignment that will have repercussions for the next several decades as the world once again increasingly becomes bipolar amid declining American influence thanks to the weakness of the feeble-minded Joe Biden.

In the wake of the invasion, the West is scrambling to further isolate and alienate Moscow by imposing as crippling sanctions as possible without pushing Vladimir Putin to nuclear war, including American companies.

For instance, VISA and MasterCard have announced they are suspending operations in Russia, which then led Russian banks to respond with an announcement last weekend they will soon begin issuing credit and debit cards using the China-based UnionPay card operator system in conjunction with Russia’s own Mir network.

Already, Sberbank, Russia’s biggest, in addition to Alfa Bank and Tinkoff have announced their switch to UnionPay.

“The development has come amidst, Visa and Mastercard, both based in the United States, announced on Saturday that they were halting operations in Russia as a result of the invasion of Ukraine and that they would work with clients and partners to stop all transactions there,” the International Business Times reports.

“All transactions started with Visa cards issued in Russia will no longer function outside of the nation within days and any Visa cards issued outside of Russia will no longer work within the country, the company said in an official statement,” the outlet continued.

The IBT also noted that the West has also barred Russian banks from participating in the SWIFT global payments system, which connects roughly 11,000 banks and financial institutions in more than 200 countries. Russia’s loss of access to the system normally would have had a major impact on foreign trade and international cash transfers, but here again, the move is liable to push Russia into China’s equivalent, the Cross-Border Interbank Payments System, or CIPS.

“China’s CIPS connects participants inside China and out to do trade or investment and then settles those transactions using Chinese yuan,” explained MarketPlace’s China correspondent Jennifer Pak.

“So let’s say I sell you shoes. Normally, you’d reach for PayPal to settle it in U.S. dollars, right? But instead, you could use CIPS and pay me in Chinese yuan. And it actually relies heavily on SWIFT’s financial messaging services. So you can think of CIPS as being enhanced by SWIFT rather than working against it,” she added, noting that the Chinese system isn’t as prevalent as SWIFT.

“CIPS says they have roughly 1,100 financial institutions from 100 countries, but they’re mostly from China, and also ones from Russia,” Pak noted.

Following Russia’s annexation of Crimea in 2014, while the Obama regime stood back and watched, Russian banks have been working to minimize their reliance on the West, in part by issuing more Mir cards, though they still lag behind international competitors like VISA and MasterCard.

Also, Pak added, it’s “feasible in theory” that Russia could switch to CIPS “but not in practice just yet.”

“For example, CIPS has its own messaging function, but this is going to take time to build up, and then, the Chinese currency isn’t as popular – just 3 percent of global payments in January on the SWIFT network were in Chinese yuan versus 40 percent In U.S. dollars,” Pak explained. “Plus, CIPS might not be an alternative if foreign sanctions are against individual banks.”

Still, the process of a new, much more dangerous multipolar world — dividing the West and the Russia-China alliance — is rapidly emerging, making conflict far more likely in the process.

While the world watches Russia dismantle Ukraine, other eyes are watching what moves China continues to make towards ‘reunifying’ Taiwan with the mainland.

That will be the next domino to fall.

Sources include:

Submit a correction >>

Tagged Under:

China, CIPS, credit cards, debit cards, finance, finances, international payments, Mastercard, multipolar world, payment processors, payment system, risk, Russia, Russian invasion, SWIFT, Ukraine, Visa, war, west

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 MARKET CRASH NEWS