U.S.-dominated global financial system facing collapse as China begins buying Russian coal and oil in yuan, not petrodollars

04/15/2022 / By JD Heyes

We have been warning since the beginning of Russia’s invasion of Ukraine that one of the negative long-term effects of imposing massive economic sanctions on Moscow would be the dismantling of the U.S. petrodollar-dominated global financial system, and that is exactly what is happening.

Not only is Russia continuing to finance its war in Ukraine, but President Vladimir Putin has also managed to bypass those sanctions with China’s help, as Beijing continues to snap up Russian energy.

While Russia requires European nations reliant on its coal and oil to pay for those commodities in “hard currency” — gold — or Russian currency — rubles — China is able to purchase both in its own currency, the yuan, as Beijing begins to build a parallel global financial system that cuts out and undermines the petrodollar.

Russian coal and oil paid for in yuan is about to start flowing into China as the two countries try to maintain their energy trade in the face of growing international outrage over the invasion of Ukraine.

Several Chinese firms used local currency to buy Russian coal in March, and the first cargoes will arrive this month, Chinese consultancy Fenwei Energy Information Service Co. said. These will be the first commodity shipments paid for in yuan since the U.S. and Europe penalized Russia and cut several of its banks off from the international financial system, according to traders.

The traders went on to say that the current purchases were the first using the Chinese yuan; the Eastern Siberia Pacific Ocean grade crude shipment is expected to arrive in Chinese ports next month.

For years, as its economy rose to be No. 2 in the world, China has been frustrated at the petrodollar’s global dominance in trade as well as the political leverage that it gives the United States, and as such, Beijing has been chipping away at the dollar’s status. Those efforts are now accelerating amid U.S.-led Western sanctions over the war in Ukraine, as Moscow is also offering rupee-to-ruble payments to India and Saudi Arabia is in discussions with China to price some of its crude stocks in yuan as well.

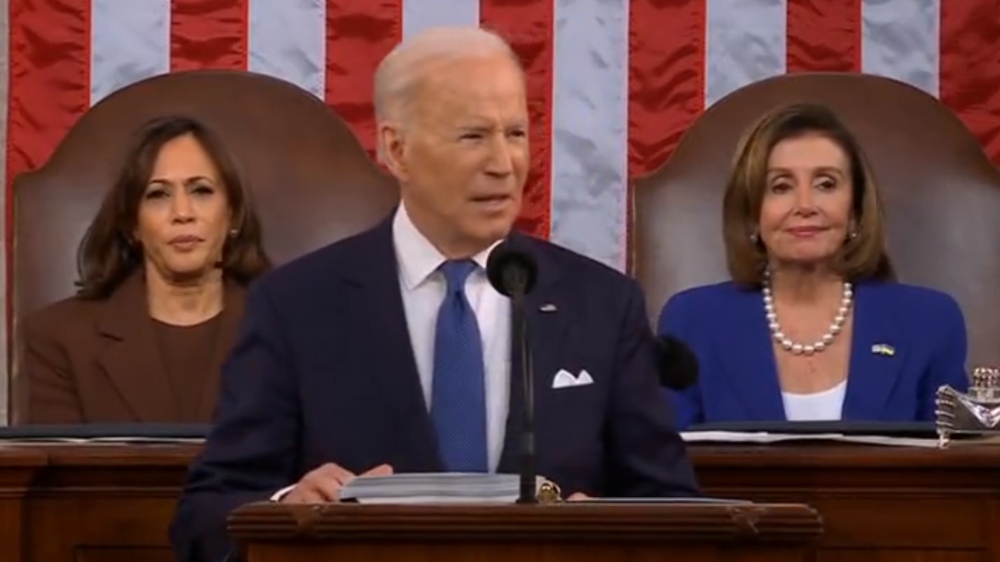

In other words, not only is the Biden regime incompetent when it comes to domestic policy but its foreign policy is being run by left-wing ideologues and amateurs who are doing more to destroy American global leadership and dominance than President Donald Trump ever did; in fact, it became strengthened under Trump.

As reported by Zero Hedge, New York Federal Reserve repo guru and current Credit Suisse strategist Zoltan Pozsar issued a stunning note last week saying that the most likely consequences of the Ukraine war are “the birth of the Bretton Woods III – a new world (monetary) order centered around commodity-based currencies in the East that will likely weaken the Eurodollar system and also contribute to inflationary forces in the West.”

“Fast forwarding to the punchline, Poszar wrote that if the framework he has laid out previously (and again, in his latest note) is the right framework to think about how to trade interest rates in coming years, inflation will be higher; the level of rates will be higher too; demand for commodity reserves will be higher, which will naturally replace demand for FX reserves (Treasuries and other G7 claims),” Zero Hedge continued in its analysis of Poszar’s forecast.

The analysis also said that at the same time, the global demand for dollars will also be much lower as well because more trade will be conducted in other currencies. As a result, “the perennially negative cross-currency basis (the dollar premium) will naturally fade away and potentially become a positive cross-currency basis,” the analysis added.

In short, that means the petrodollar is on the way out as the world’s global reserve currency, and that will have an extremely negative impact on the U.S. economy, as interest rates rise, inflation spins out of control and debt payments on our $30-plus trillion national debt become unsustainable.

Sources include:

Submit a correction >>

Tagged Under:

Bubble, chaos, China, coal, Collapse, commodities trading, currency, dollar, Dollar Collapse, dollar dominance, fiscal collapse, oil, petrodollar, Russia, Russian invasion, sanctions, U.S. dollar, Ukraine, US debt, yuan

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 MARKET CRASH NEWS