European Central Bank head warns of darkening economic outlook for the continent, raising recession fears

09/27/2022 / By Arsenio Toledo

European Central Bank (ECB) President Christine Lagarde said on Monday, Sept. 26, that the economic outlook for the continent “is darkening” as it faces lower-than-expected economic growth due to uncontrolled inflation

Lagarde made her remarks before the European Parliament’s Committee on Economic and Monetary Affairs during a hearing regarding whether the Eurozone – the areas in Europe where the euro has been adopted as the primary currency – would sink into recession.

The ECB president said the bank’s baseline scenario has been subdued due to diminished economic growth, saying that inflation is still far too high “and is likely to stay above our target for an extended period.”

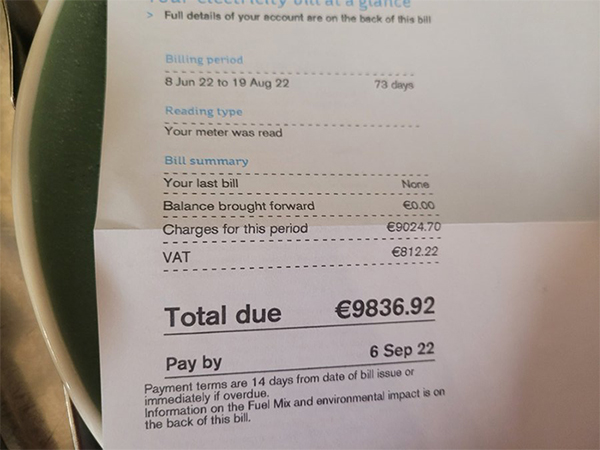

Lagarde also blamed Russia and its special military operation in Ukraine for the crisis, claiming that its “economic consequences” for the Eurozone “continue to cast a shadow over Europe” since June, a reference to Western sanctions on Russian energy exports which have sent fuel prices surging. Higher fuel prices have dampened consumer spending, limited production by businesses and contributed to inflation.

In her forecast, Lagarde strongly recommended that Eurozone nations adapt their welfare programs to target the neediest, warning that providing the continent’s residents with across-the-board handouts would not help the fight against inflation. Much of the support being provided at the moment is “tailored, temporary and targeted” and there is more “work to be done” to adjust the approach.

Among Lagarde’s recommendations were providing households and businesses with temporary subsidies to offset soaring energy costs.

Lagarde’s current prediction regarding the state of the European economy is in stark contrast to predictions she made in June and July that there won’t be a recession.

In late June, during a meeting with other central bank officials in Portugal, Lagarde downplayed concerns about a recession in the Eurozone, saying that growth won’t go down enough to trigger a recession. (Related: ANALYSIS: Europe to become “ECONOMIC WASTELAND” as industry dies, banks fail and food production plunges.)

“We have markedly revised down our forecasts for growth in the next two years. But we are still expecting positive growth rates due to the domestic buffers against the loss of growth momentum,” Lagarde said at the time.

Lagarde doubled down on this claim in late July, when she said economic forecasts still do not predict a recession this year or the next. She made these comments while supporting the ECB’s move to raise interest rates for the first time in 11 years by 50 basis points (0.5 percent). This was followed up with a 75 basis point (0.75 percent) rate hike earlier this month. Neither rate hike has succeeded in curbing inflation.

Economic situation unlikely to improve until 2024

Lagarde’s current prediction suggests that the Eurozone’s economy will grow by 0.8 percent in the second quarter, and growth for the rest of the year will be substantially slower. Year-over-year growth is expected to be 3.1 percent.

Annual growth for 2023 is projected to be just 0.9 percent. Current forecasts estimate that things will marginally improve in 2024, with growth projected at 1.9 percent.

European inflation hit 9.1 percent in August, driven by massive increases in the cost of energy and food. The ECB has increased its inflation projections accordingly. Year-over-year inflation for 2022 is expected to be 8.1 percent, 5.5 percent for 2023 and 2.3 percent in 2024. Lagarde again pinned the blame for inflation on Russian operations in Ukraine, causing “major disruptions in energy supplies.”

Lagarde concluded by warning that the situation is expected to “get worse before it gets better,” especially with regard to the high costs of food and energy.

Learn more about the coming economic collapse at Collapse.news.

Watch this episode of the “Health Ranger Report” as Mike Adams, the Health Ranger, predicts how Europe is about to turn into an “economic wasteland” as the banks fail and industries shut down.

This video is from the Health Ranger Report channel on Brighteon.com.

More related stories:

Europe is collapsing, and it’s just the first domino of many to fall.

The economic ANNIHILATION of Europe – Gonzalo Lira and Mike Adams publish epic interview.

Western Europe now facing “TOTAL FINANCIAL COLLAPSE” – experts and analysts urgently sound the alarm.

DARK TIMES: Industry and infrastructure collapsing by the day across Europe and the USA.

Central banks are willing to destroy the global economy if it means saving the stock market.

Sources include:

Submit a correction >>

Tagged Under:

Bubble, chaos, Christine Lagarde, Collapse, debt bomb, debt collapse, economic collapse, economics, economy, Europe, European Central Bank, European Union, finance, Inflation, market crash, money supply, panic, recession, risk

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 MARKET CRASH NEWS