U.S. financial markets are so fragile that now people who describe expected corrections are BLAMED for causing the crash

03/28/2020 / By JD Heyes

In today’s topsy-turvy world, up is down, down is up, and speaking the truth is bad.

Because hearing the truth is painful.

In recent days, noted investor Bill Ackman, founder of Pershing Square Capital Management, said that it is imperative President Donald Trump order the complete shutdown of the entire country for 30 days or else collapse is certain, as Natural News reported.

“What’s scaring the American people and corporate America now is the gradual rollout,” Ackman said. “We need to shut it down now… This is the only answer.

“America will end as we know it. I’m sorry to say so, unless we take this option,” he continued, noting that if the president does save the country from the ravages of coronavirus, he’ll get reelected in November for certain.

One other thing: Ackman urged companies to stop their buyback programs because “hell is coming” — advice that our businessman-president also gave a few days later. Indeed, Trump said he would support banning buybacks as part of the coronavirus relief bill he signed Thursday, noting that he didn’t want companies using federal taxpayer dollars to improve their market positions at the expense of workers.

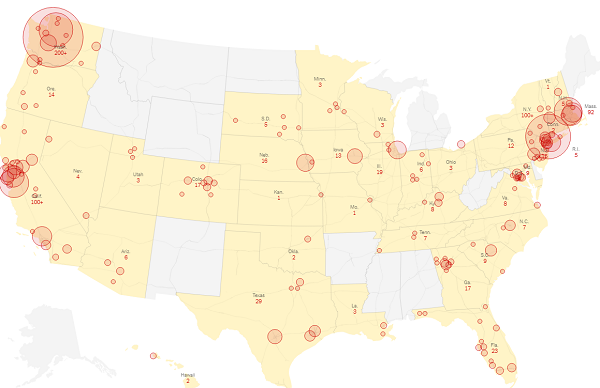

On Friday, in an interview with CNBC, Ackman defended his call for the president to shutter the country for a month and pushed back hard against critics who claimed that his warning actually led to major market losses over the past several days (the Dow Jones index was off 900 points on Friday but up for the week).

“Shortly after the show, I heard that some had interpreted my remarks as being very bearish on the market,” Ackman told investors on Thursday. “The idea that my appearance pushed the market down an additional 4% that day is absurd.”

‘A number of press reports have raised questions’

“Yes, I got somewhat emotional as I talked about protecting my immune-compromised father from the ravages of the virus. But, I had become bullish because of my belief that the entire country would soon go into lockdown, and that would be the fastest and best way to minimize the impact of the virus,” he added.

Investors and market analysts were critical, however, because they say that the billionaire investment analyst would profit from further market declines due “to a series of prescient bets made in February,” CNBC added.

He revealed March 3 that he had bought a variety of credit default swaps on investment-grade and high-yield indexes, which was essentially buying insurance on credit “which would increase in value as the underlying assets deteriorated and spreads widened,” CNBC noted.

Ackman explained in a March 3 note that he bought the default swaps as a hedge against the market if efforts to contain the spread of the virus wound up having an enormously negative impact on the U.S. and global economies, which he believed was likely (that much is true).

But other analysts have argued that his appearance on CNBC March 18 in which he issued his dire warnings was simply him trying to cash in on a market he allegedly helped drive down.

“A number of press reports have raised questions about my appearance on CNBC last Wednesday, and some have even questioned whether my appearance was intended to drive down the market so that we could profit on hedges we had previously entered into,” he wrote in a letter to investors this week.

He repeated that he said during the March 18 interview that he had begun to add Pershing’s existing stock holdings because equities looked inexpensive amid a historic market sell-off.

That is why we are buying stocks. These are bargains of a lifetime if we manage this crisis correctly.

— Bill Ackman (@BillAckman) March 18, 2020

For all the world it sure seems as though Ackman is being criticized for doing what he does best: Forecasting what will happen to the markets, not driving the markets down with a lone analyst’s words.

Sources include:

Tagged Under: analysis, analyst, Bill Ackman, Collapse, coronavirus, covid-19, forecast, global economy, outbreak, pandemic, predictions, President Trump, stock market, stocks, twisted, U.S. economy, Wall Street

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 MARKET CRASH NEWS